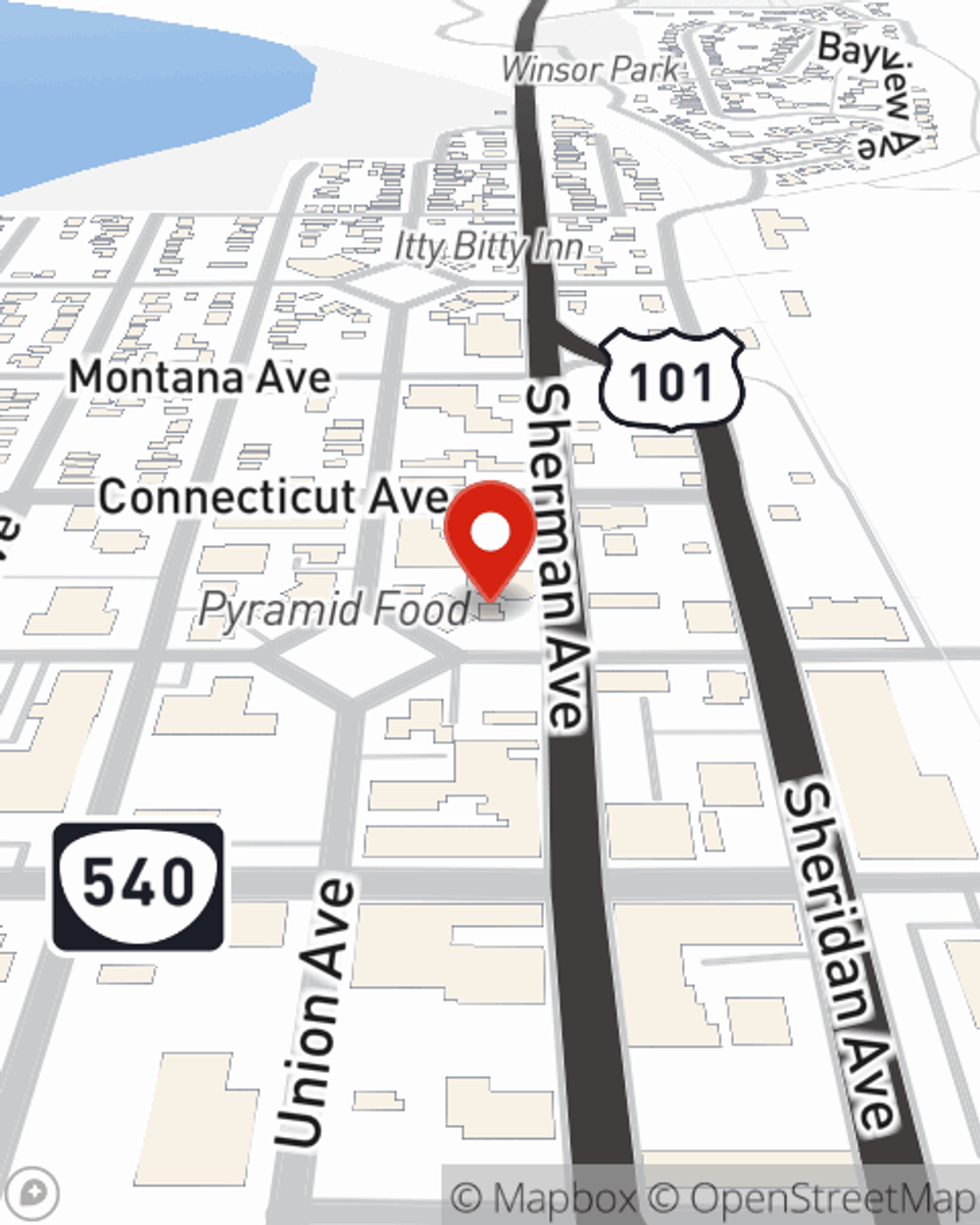

Business Insurance in and around North Bend

Looking for small business insurance coverage?

This small business insurance is not risky

Your Search For Remarkable Small Business Insurance Ends Now.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected damage or accident. And you also want to care for any staff and customers who become injured on your property.

Looking for small business insurance coverage?

This small business insurance is not risky

Insurance Designed For Small Business

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like extra liability or errors and omissions liability, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent John Gibson can also help you file your claim.

Eager to research the specific options that may be right for you and your small business? Simply reach out to State Farm agent John Gibson today!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

John Gibson

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.